What could I miss doing that could ruin my retirement?

Article Licenses: CA, unknown, unknown

Advisor Licenses:

Compliant content provided by Adviceon® Media for educational purposes only.

Perhaps you haven’t started investing regularly, or the amount you allocate is not enough to reach your retirement goals. Here are a few of the things people are not doing that can ruin otherwise good investment goals.

Not viewing debt as negative investment earnings. If you are paying 18% interest on a credit card while earning 8% in an investment, that immediately places you in a 10% loss position per dollar compared. Moreover, where else can you get such a guarantee on your investment return, as you can by investing in your debt repayment? By paying off $5,000 over one year, you’ll earn $900 risk-free and you won’t have to pay that with after-tax dollars ever again.

Unsecured credit card debt can kill a once-healthy budget, while substantially reducing your income. And opportunities can suffer when your cash flow is crippled by debt. It is harder to solve the need for emergency cash if you are debt-ridden.

Especially look at paying down debts that carry interest that cannot be written off as you are paying for both the principal and the interest with after-tax dollars.

Not putting money away into an emergency fund. If an emergency arises you should be able to access a simple bank account to cover up to three to six months’ worth of living expenses such as your rent or mortgage, food, debt repayment, car payments, etc. Consider using a money market fund for this savings plan.

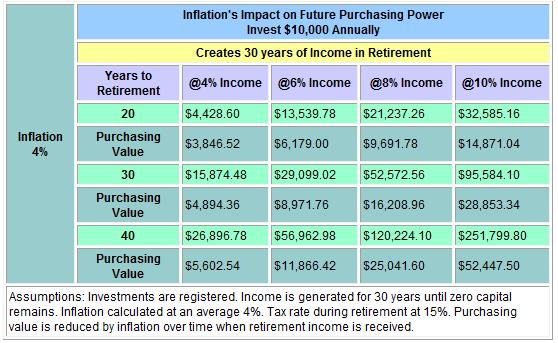

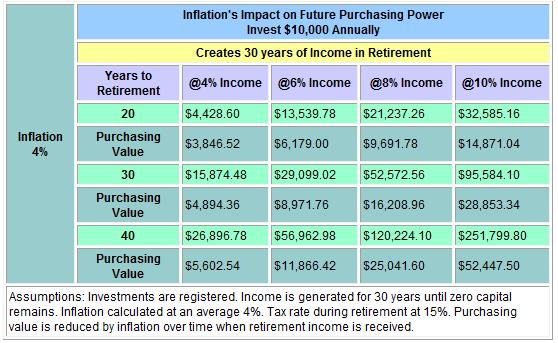

Not assessing your retirement time horizon. You can analyze what you will need to invest annually, by running calculations to see if you will have sufficient income to live on. Confer also with your advisor about how you can get there over your remaining employment years, by investing with a clear vision.

Not assessing the impact of inflation on your retirement income. Refer to this table to see how inflation can affect your retirement plan.

Planning for your dependants. Make sure you have sufficient life insurance to pay off your total debts such as: credit card balances, car loans, IOUs, and any business-related debt. Incorporate this with sufficient coverage to provide future income for your dependants. This is especially necessary if your debt exceeds your annual income as it does for the average Canadian household where debt runs at 150% of income. Source: The Vanier Institute of the Family, February 2011

The Advisor and Manulife Securities Incorporated, ("Manulife Securities") do not make

any representation that the information in any linked site is accurate and

will not accept any responsibility or liability for any inaccuracies in

the information not maintained by them, such as linked sites. Any opinion

or advice expressed in a linked site should not be construed as the opinion

or advice of the advisor or Manulife Securities. The information in this

communication is subject to change without notice.

This publication contains opinions of the writer and may not reflect opinions

of the Advisor and Manulife Securities Incorporated, the information contained

herein was obtained from sources believed to be reliable, no representation,

or warranty, express or implied, is made by the writer, Manulife Securities or

any other person as to its accuracy, completeness or correctness. This

publication is not an offer to sell or a solicitation of an offer to buy any

of the securities. The securities discussed in this publication may not be

eligible for sale in some jurisdictions. If you are not a Canadian resident,

this report should not have been delivered to you. This publication is not

meant to provide legal or account advice. As each situation is different you

should consult your own professional Advisors for advice based on your

specific circumstances.